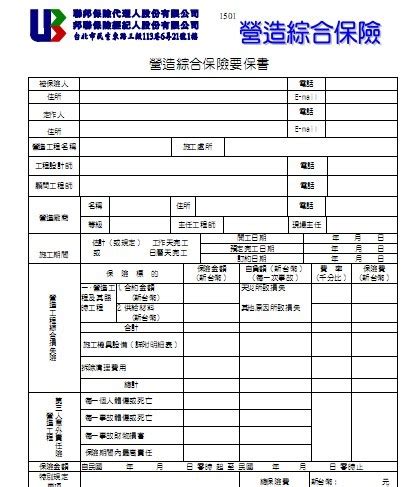

Insurance Policy Document in English

An insurance policy document, also known as an insurance contract or policy, is a legal contract between the insurance company and the policyholder. It outlines the terms and conditions of the insurance coverage and serves as a proof of the agreement between the two parties. Below is a typical structure and content found in an insurance policy document in English:

1.

Title Page:

The title page usually includes the name of the insurance company, policy number, effective date, and expiration date of the policy.

2.

Table of Contents:

A table of contents is often included for the easy reference of the sections and clauses within the policy document.

3.

Insuring Agreement:

This section states the perils or risks covered by the insurance policy. It outlines the obligations of the insurance company to provide coverage and the obligations of the policyholder to pay premiums.

4.

Definitions:

Definitions of key terms and concepts used throughout the policy are clarified in this section to avoid ambiguity.

5.

Coverage Details:

Specific details of the coverage provided by the policy, including the types of losses or damages covered, exclusions, limitations, and conditions.

6.

Policy Terms and Conditions:

This section explains the general terms and conditions of the policy, including the duties of the policyholder, claim procedures, cancellation terms, and any other requirements that both the insurer and the insured must adhere to.

7.

Premium Payment Details:

Information regarding the amount of premium, mode of payment, due dates, and consequences of late payment are included in this section.

8.

Endorsements and Riders:

Any changes or additions to the standard policy terms are listed in this section. These changes are known as endorsements or riders.

9.

Claims Process:

Details on how to file a claim, the documentation required, and the process that will be followed by the insurance company to settle the claim.

10.

Cancellation and Renewal:

This section outlines the terms under which the policy may be canceled by either party, as well as the procedures for renewal.

11.

Exclusions:

Specific events, conditions, or situations that are not covered by the policy are listed here.

12.

Other General Information:

Contact information for the insurance company, the governing law of the contract, and any other relevant information.

It's important for the policyholder to thoroughly read and understand the contents of the insurance policy document to ensure that they are aware of their rights and obligations. If there are any terms or clauses that are unclear, seeking clarification from the insurance company or a legal professional is advisable.

I have provided an outline of the typical structure and content found in an insurance policy document in English. If you need more specific information or have any particular questions regarding insurance policy documents, feel free to ask!